News

1

1TIPO Annual Report 2024 Released

TIPO is pleased to announce the publication of its 2024 Annual Report, highlighting its significant developments and achievements in the field of intellectual property over the past year.● The average first office action pendency and the average disposal pendency for invention patents were 8.4 and 14.2 months, respectively.● The average first office action pendency and the average disposal pendency for trademarks were 6.1 and 7.4 months, respectively.● Implemented the Accelerated Examination Program for Reexamination (AEPRe) to grant patents in as fast as 15 days● Launched brand new AI-assisted trademark image search in March to streamline searches for identical or similar trademarks● Promoted Taiwan Patent GO since April to showcase excellent patents in international exhibitions and facilitate business opportunities.● Enforced in May: Partial amendments to the Trademark Act● In June: New Southbound Intellectual Property Conference● In October: Taiwan-Philippines MOU on cooperation in intellectual property extended for four years● The percentages of online patent and trademark applications were 91.5% and 89.2%, respectively. 2

2TIPO–INPI Patent Prosecution Highway (PPH) to Launch July 1, 2025, Boosting Global Patent Strategy and Competitiveness

On May 21, 2025, during the Taiwan–France Economic Dialogue, TIPO Director General Cheng-Wei Liao and Director General Pascal Faure of the National Institute of Industrial Property (INPI, France) signed a Statement of Intent (SOI) on the Patent Prosecution Highway (PPH) between TIPO and INPI. The signing was witnessed by Representative Hao Pei-chih, Taiwan’s Representative to France, and Franck Paris, Director of the French Office in Taipei. The new PPH program will take effect on July 1, 2025, symbolizing a major milestone in Taiwan–France IP cooperation.The PPH program is a mechanism that speeds up the patent examination process by allowing patent offices to share examination results and search reports, reducing duplicative work and improving both efficiency and quality. The Taiwan–France PPH will allow companies to secure patent rights more quickly and streamline their global patent portfolios.The first TIPO-USPTO PPH program began in 2011, and TIPO has since launched PPH programs with five other partners: Japan, Spain, South Korea, Poland, and Canada. France is now the seventh partner, expanding Taiwan’s global PPH network. According to TIPO statistics, the average pendency for PPH requests in 2024 was just 4.4 months, significantly shorter than the general average of 14.15 months.Director General Liao emphasized that France was Taiwan’s 18th largest trading partner globally in 2024 and its third largest within the EU, with bilateral trade reaching US$6.538 billion. As a key European economic partner, France plays a vital role in Taiwan’s innovation ecosystem. The Taiwan–France PPH agreement enhances a friendlier cross-border patent application environment, helping businesses secure faster patent approvals and gain a competitive edge. Moving forward, TIPO and INPI will continue to deepen cooperation to support the intellectual property needs of industries in both countries and promote sustainable growth. 3

3TIPO Promotes Design Patent Awareness and Practice at the 2025 Young Designers’ Exhibition

The 44th Young Designers’ Exhibition (YODEX) was held from May 9 to 12, 2025, at Taipei Nangang Exhibition Center Hall 2. In support of the event, the TIPO set up the Taiwan Patent GO Pavilion, aligning with this year’s theme, “preferred future.” The pavilion showcased a curated selection of patent-related resources and initiatives. On May 9, TIPO patent examiners also held a special seminar to help students better understand how to use design patents to protect and elevate their creations in their future careers.At the exhibition, TIPO highlighted not only the steps for filing design patents, but also offered on-site consultations by IP professionals to encourage students to transform creative ideas into tangible competitive advantages through intellectual property protection.TIPO emphasized that the Taiwan Patent GO Pavilion will continue to appear at major exhibitions and events nationwide, offering tailored patent information and support for designers, inventors, and entrepreneurs. The initiative reflects the government's commitment to fostering innovation and design, and its active efforts to build a supportive environment where creativity and IP protection go hand in hand. 4

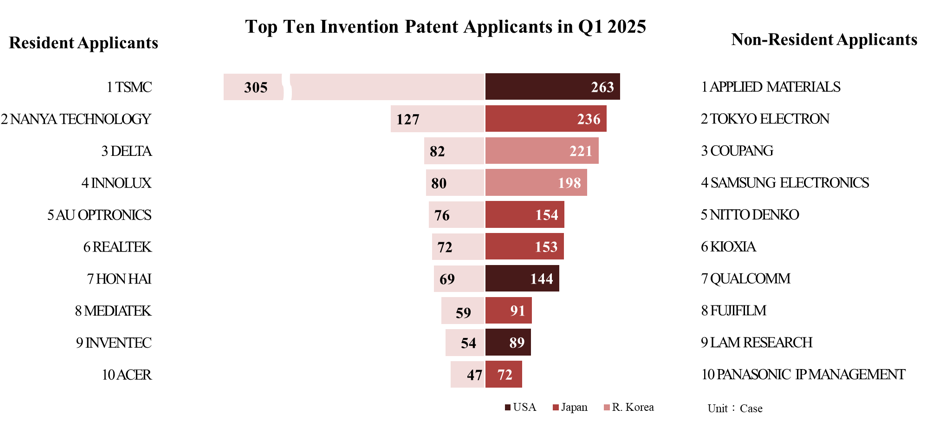

4TIPO’s Q1 2025 IPR Statistics Report

Overall Trends in Patent and Trademark ApplicationsIn the first quarter of 2025, TIPO received a total of 17,063 patent applications, comprising 12,202 invention patents, 3,232 utility model patents, and 1,629 design patents. This represents a 1% increase compared to the same period in 2024, with invention patent filings rising by 2% (Figure 1). Patent applications filed by resident and non-resident applicants accounted for 47% and 53% of the total, respectively. Compared to the same period last year, applications by residents declined by 2%, whereas those by non-residents rose by 5%.A total of 21,099 trademark applications were filed. Since a single trademark application may be designated across multiple classes, the total number of classes covered by trademark applications reached 27,445, a 2% increase (Figure 2). Among these, resident applicants accounted for 77%, while non-resident applicants made up 23%. The number of trademark classes, originally on a decline, has shifted to growth.Overview of Patent Applications Filed by ResidentsTop Ten Invention Patent ApplicantsAmong the 4,355 invention patent applications filed by resident applicants, 3,534 were submitted by businesses. TSMC led the top ten resident applicants with 305 filings, followed by Nanya Technology (127), Delta (82), Innolux (80), AU Optronics (76), Realtek (72), Hon Hai (69), MediaTek (59), Inventec (54), and Acer (47) (Figure 4). Notably, TSMC has held the top position for six consecutive years since the first quarter of 2020. Another highlight is Delta, which posted its strongest single-quarter performance ever, both in terms of application number and ranking.Top Five Design Patent ApplicantsResident applicants filed 682 design patent applications. The top five applicants were L&F Plastics with 27 applications, followed by Tarng Yu (22), Acer (18), Crown (12), and a four-way tie between Tong Yah, Evolutive, Shin Tai, and Gudeng, each with 9 applications (Figure 5). L&F Plastics has held the top position for two consecutive years, while both Evolutive and Gudeng made their debut appearances in the top five.Overview of Patent Applications Filed by Non-ResidentsFiling Countries (Regions) of Invention Patent ApplicantsNon-resident applicants filed 7,847 invention patent applications. The top five countries/regions are Japan with 3,538 applications, followed by the US (1,624), R. Korea (828), Mainland China (706), and Germany (230) (Figure 3). All five countries/regions saw year-on-year growth in application numbers. In particular, applications from Japan and R. Korea increased by 213 and 113 cases respectively, reflecting a growing emphasis on the Taiwanese market.Top Ten Invention Patent ApplicantsAmong the top ten non-resident applicants for invention patents, Applied Materials from the US ranked first with 263 applications. It was followed by Tokyo Electron (236) from Japan, Coupang (221) from R. Korea, Samsung Electronics (198) from R. Korea, Nitto Denko (154) from Japan, Kioxia (153) from Japan, Qualcomm (144) from the US, Fujifilm (91) from Japan, Lam Research (89) from the US, and Panasonic IP Management (72) from Japan (Figure 4).Applied Materials (US) maintained its leading position among non-resident applicants for the third consecutive year, together with four other companies—Tokyo Electron (Japan), Kioxia (Japan), Lam Research (US), and Panasonic IP Management (Japan)—each setting their own record for the highest single-quarter performance. This trend underscores Taiwan’s strategic role in global semiconductor production and R&D, attracting equipment suppliers and related industries to strengthen their technical and market protections in Taiwan. Taiwan’s technological capability and comprehensive regime for intellectual property protection also draws international investors.Filing Countries (Regions) of Design Patent ApplicantsNon-resident applicants filed 947 design patent applications. The top five countries/regions were the US with 219 applications, followed by Japan (212), Mainland China (160), Switzerland (79), and R. Korea (54) (Figure 3). Notably, the US surpassed Japan this quarter to take the top position.Top Five Design Patent ApplicantsAmong the top five non-resident applicants for design patents, Beijing Roborock from Mainland China led with 58 applications, followed by Apple (45) from the US, Molex (37) from the US, Harry Winston (31) from Switzerland, and Renault (30) from France (Figure 5). All five companies recorded year-on-year growth in application numbers, highlighting the increasing importance of the Taiwanese market and the need to actively invest resources to safeguard the competitive edge of product designs.Overview of Trademark Registration ApplicationsTop Ten Resident Applicants for TrademarksResident applicants filed 16,188 trademark applications. Among the top ten applicants, Uni-President ranked first with 122 applications, followed by TSG Hawks (111), Che Tai (87), Nan I Book (83), Xing Han (75), Amber Dong Fu and A-Top Health (both with 43), Chunghwa Post (42), Adam (40), and Videoland (38) (Table 1). Except for Uni-President, all other top ten applicants recorded year-on-year growth.NICE Classification of Resident ApplicationsThe top three categories of trademark applications filed by resident applicants were as follows: Class 35 (advertising, business management, retail and wholesale services, etc.) with 3,179 applications, Class 43 (restaurants, lodgings, etc.) (1,529), and Class 30 (coffee, tea, pastries, etc.) (1,352) (Figure 7). This trend indicates that domestic businesses tend to focus their trademark applications on business operations, as well as consumer-related services such as restaurants and accommodations, and products like coffee and pastries.Filing Countries (Regions) of Non-Resident ApplicationsNon-resident applicants filed 4,911 trademark registration applications. The top five countries/regions were Mainland China with 1,212 applications, followed by Japan (757), the US (708), R. Korea (633), and Singapore (223) (Figure 6). Except for Mainland China, the number of applications from the other four countries increased. Japan, R. Korea, and Singapore have seen positive growth for two consecutive years, reflecting a stronger focus on trademark and brand protection in the Taiwanese market by companies from these countries.Top Ten Non-Resident Applicants for TrademarksAmong the top ten non-resident applicants for trademark registration, JYP from R. Korea ranked first with 63 applications, followed by Musinsa (60) from R. Korea, Goodbaby (42) from Mainland China, GR OPCO (41) from the US, Huawei (34) from Mainland China, Huang, Cheng-fang (33) from Mainland China, Tencent (26) from Cayman Islands, Blooming (25) from R. Korea, CYYS (24) from Hong Kong, and the Row Holdings (22) from the US (Table 2). Except for Tencent, which saw a 38% decrease in applications, all other top ten applicants recorded year-on-year growth.NICE Classification of Non-Resident ApplicationsThe top three categories of trademark applications filed by non-resident applicants were as follows: Class 9 (computer and technology products, etc.) with 966 applications, Class 35 (advertising, business management, retail and wholesale services, etc.) (623), and Class 3 (cosmetics and detergents, etc.) (550) (Figure 8). Non-resident applicants have focused primarily on registering trademarks in Class 9 (computer and technology products, etc.), which had the most applications and experienced a higher growth rate.Analysis of Applications by IndustryThe most commonly filed trademark applications in Taiwan were in the “Agriculture” industry, with 5,190 applications, leading all industries. This was followed by “Health” (4,337) and “Business services” (4,289).The top three industries for trademark applications were as follows: for resident applicants, “Agriculture” led with 4,361 applications, primarily driven by trademark filings from restaurants and accommodation services; for non-resident applicants, “Research and technology” had the highest number of filings with 1,477 applications (Figure 9). Additionally, resident applicants saw year-on-year growth in the “Business services” industry, while non-resident applicants experienced growth in “Research and technology,” “Health,” and “Clothing and accessories.”Note: The above statistical data is based on the “first applicant” of the applications when referencing applicants and nationalities. Reference URL: https://www.tipo.gov.tw/en/lp-302-2.html 5

5The 15th Edition of the Locarno Agreement Establishing an International Classification for Industrial Designs Now in Effect

The 15th Edition of the Locarno Agreement Establishing an International Classification for Industrial Designs, administered by WIPO, officially came into effect on January 1, 2025. TIPO has completed the Chinese translation and prepared a comparison table between the old and new versions for public reference.Key updates in this edition include: new categories for lighting fixtures and personal grooming products, as well as more detailed classification for graphic designs and virtual reality (VR) products to reflect the needs of emerging industries and current design trends. 6

6“Rhythms of Music and IP: Launching Creative Protection” Forum a Resounding Success!

In celebration of World IP Day 2025 and the theme, “IP and Music”, TIPO collaborated with the Music Copyright Society of Chinese Taipei (MÜST) and the Taipei Music Center (TMC) to organize the “Rhythms of Music and IP: Launching Creative Protection” Forum. The event took place on April 29, 2025, at the Live House D exhibition space of Taipei Music Center, drawing over 150 participants from the music industry, academia, and the creative community. The event was marked by lively interaction, reflecting a strong collective interest in music and intellectual property rights.In his opening remarks, Director General Cheng-Wei Liao expressed his gratitude for the opportunity to co-host this event with MÜST and TMC—two organizations deeply rooted in Taiwan's music industry. He noted that the seminar's theme echoed WIPO's 2025 focus, “IP and Music: Feel the Beat of IP.” Director General Liao emphasized the importance of recognizing the value of musical creativity, exploring innovative cross-industry applications, and understanding the significance of intellectual property rights protection.TIPO highlighted that with the rapid advancement of digital technology and the growing diversity of music creation and distribution, it is crucial to stay ahead of industry changes, support creators in safeguarding their rights, encourage lawful licensing, and promote both industry growth and innovative applications. TIPO remains committed to these goals, seeking to inject greater momentum into Taiwan's music and creative industries. 7

7TIPO Organizes 2025 Information Sessions on Patent and Trademark Laws

TIPO will hold a series of Information Sessions on Patent-Related Laws and Information Sessions on Trademark-Related Laws on May 14, May 16, and May 23, 2025, in Taipei, Kaohsiung, and Taichung, respectively. Each city will host one session for patents and one for trademarks.The patent information session will cover the latest updates to the examination guidelines for invention and utility model patents, highlighting key amendments. Meanwhile, the trademark information session will provide a detailed explanation of critical articles from the Trademark Act, addressing common practical issues encountered recently. Additionally, the session will introduce TIPO's new trademark search system, offering tips to help industry professionals improve search accuracy and application efficiency. 8

82025 IPR Expert Service Group Seminar Now Open for Application

TIPO is now accepting applications for the 2025 IPR Expert Service Group Seminar. This seminar is designed for businesses, government agencies, educational institutions, private organizations, and the general public interested in learning more about intellectual property rights (IPR), rights protection, and fair use. All those looking to deepen their understanding of IPR-related topics or have questions about IP protection, are encouraged to apply.There are no restrictions on the type of applicant – enterprises, government institutions, and civilian organizations are all eligible. Organizations may also file joint applications. Participants can choose between in-person or online sessions. The seminar fee covers the instructor's hourly rate (NT$2,000 per hour) and travel expenses. 9

9TIPO Launches the New iPKM – Now Available!

To align with the government’s cloud policy and enhance service quality, TIPO officially launched the new iPKM on December 18, 2024. This revamped platform, accessible at https://cloud.tipo.gov.tw/S400, integrates the previous desktop and mobile versions into a seamless, cross-device experience. The updated user interface provides streamlined access to patent document searches, expert articles, the latest IP news, information on international patent systems, and more.Please note that the previous version of the platform will be taken offline on April 25, 2025. We encourage all users to switch to the new platform as soon as possible to continue enjoying comprehensive IP information services.Please direct any questions or feedback regarding the new system to the "Contact Us" page at https://cloud.tipo.gov.tw/S400/question/contact-us. 10

10The Taipei Invention Awards Competition of tie is Now Open for Registration!

The 2025 Taiwan Innotech Expo (tie) is set to take place from October 16 to 18, 2025 at the Taipei World Trade Center Hall 1. This year’s theme centers around using AI to drive cross-domain innovation and futuristic smart technology, highlighting the integration of AI applications with Taiwan's leading industries. tie 2025 sets the stage for global tech trends and draws international buyers and research institutions for exhibition and exchange.The 2025 Taipei Invention Awards Competition will also be held simultaneously in Exhibition Hall B. Inventors, manufacturers, and academic institutions with innovative ideas and passion are encouraged to sign up and showcase their work.Hosted by TIPO, the 2025 Taipei Invention Awards Competition will feature a distinguished panel of judges from industry, government, and academia who will evaluate the patents presented. An Awards Ceremony will be held on the final day of the exhibition to honor outstanding inventors and exemplary exhibitors, offering them opportunities for media exposure.tie provides a powerful platform for inventors to boost the visibility of their patents through digital networks, media, social platforms, and newsletters. This platform not only attracts industry attention but also facilitates industry-academia cooperation, technology transactions, and resource networking. The 2025 Taipei Invention Awards Competition Registration Guide is now available on the tie official website. Don't miss out on the opportunity to participate! 11

11TIPO Launches the 2025 Competition for Patent Portfolio Analysis

TIPO's 2025 Competition for Patent Portfolio Analysis is now open for registration until April 30, 2025. With a total prize pool of NT$300,000, the competition continues to adopt its innovative “Corporate Challenges x Talent Solutions” format, incorporating real-world business needs and industry priorities, in hopes that domestic patent analysis professionals across different sectors can participate.Since 2021, TIPO has hosted this annual event to foster a platform for cross-sector collaboration and to promote knowledge exchange on patent portfolio strategies and industry trends. This year, 30 enterprises have submitted 53 topics across diverse technical fields, including electronics and electrical engineering, ICT, biotechnology and pharmaceuticals, mechanical manufacturing, optics and imaging, smart healthcare, and green energy.To strengthen participants' practical skills, a series of hands-on training courses will be held during the competition, covering patent search techniques, data analysis methods, and strategies for building effective patent portfolios. Final results will be showcased at the award ceremony and exhibition, offering participants valuable networking opportunities with industry professionals.TIPO aims to bridge industry, academia, and research through this competition, cultivating future professionals in patent analysis while helping enterprises identify talent and stay ahead of technological trends. 12

12TIPO Updates Taiwan-Japan and Taiwan-Korea Concordance Tables for Nice Classification (12th Edition – Version 2025)

To align with the latest updates to the Nice Classification (12th Edition – Version 2025) issued by the World Intellectual Property Organization (WIPO), TIPO has released updated versions of its Taiwan-Japan and Taiwan-Korea Concordance Tables for Similar Group Codes of Goods and Services.These concordance tables serve as practical references for applicants in Taiwan, Japan, and Korea who plan to file trademark applications with TIPO, the Japan Patent Office (JPO), or the Korean Intellectual Property Office (KIPO). By using the updated group code comparisons, applicants can more efficiently and accurately identify the designated goods or services, and conduct prior similarity searches to avoid conflicts with existing trademarks. 13

132025 TIPA "Origins: Blossoms in Bloom" Graphical Mark Seminar & Promotion Exhibition Concludes Successfully

The 2025 TIPA “Origins: Blossoms in Bloom” Graphical Mark Seminar & Promotion Exhibition, hosted by TIPO, was held on March 15, 2025, at National Taiwan University.At the exhibition, a diverse array of distinctive local agricultural products were showcased, including beans (soybeans, red beans, and black beans) from Meinong, Dong Ding Oolong tea from Lugu, jujubes from Gongguan, rice from Luye, black tea from Sun Moon Lake, taro from Dajia, rice from Chishang, rice from Sanxing, red beans from Wandan, and coffee from Guoxing. Interactive games were also featured on-site to help visitors understand the significance of graphical marks, i.e. graphical certification marks and graphical collective trademarks, and how they promote product quality and regional identity.The afternoon seminar invited scholars and experts—along with graphical mark holders from organizations such as the Meinong Farmers’ Association (Kaohsiung City), Lugu Township Office (Nantou County), Gongguan Farmers’ Association (Miaoli County), and Luye Township Office (Taitung County)—to share practical insights and challenges in promoting graphical marks. The event drew over 170 attendees, generating enthusiastic discussions and engagement.In his opening remarks, TIPO Director General Cheng-Wei Liao emphasized that graphical marks are not only a symbol of origin, but also a promise of quality and integrity. In an increasingly globalized market, clear and trustworthy origin labeling builds consumer confidence. As demand for product traceability and quality assurance grows, graphical marks will continue to play an essential role in shaping market differentiation and trust.Since Chishang Rice registered Taiwan’s first certification mark in 2003, TIPO has continued to promote the graphical mark registration system. To date, 78 valid graphical marks have been registered across Taiwan, covering a variety of agricultural products including rice, tea, and fruit. With the rise of climate change, technological advances in agriculture, and regional revitalization policies, more emerging crops and specialty products are entering the market. TIPO will further collaborate with the Ministry of Agriculture to boost local economies through more small-scale agriculture, which can create more added value. We will continue to offer guidance and consultation services for the registration of graphical marks to support the development of local industries, foster niche advantages, and furnish global competitiveness for Taiwanese agricultural products. 14

14TIPO Welcomes All to the Key Components and Thermal Management Technologies in EVs Seminar at the 360° MOBILITY Mega Shows

In response to the global push for net-zero emissions in the automotive industry, Taiwan is actively advancing its goal of achieving full electrification of transport by 2050. A key part of this strategy involves developing core electric vehicle (EV) components. As EVs become increasingly intelligent and high-performing, thermal management has emerged as a major technical challenge.To support Taiwan's automotive sector with up-to-date patent insights, TIPO conducted a patent trend analysis in 2024 using its patent databases and the Global Patent Search System (GPSS). The study examined patents related to EV thermal management technologies filed between 2014 and 2023, categorized into three key areas: battery cooling, motor cooling, thermal management systems. The results offer a comprehensive look into the global R&D landscape for EV key component's heat dissipation and thermal management technologies.At the invitation of TAITRA, TIPO will present these findings at the 2024 360° MOBILITY Mega Shows. The seminar, titled “Key Components and Thermal Management Technologies in EVs,” will be held on April 24, 2025, at 11:00 AM at TaiNEX 1.TIPO will also participate under the Taiwan Patent GO Pavilion brand, collaborating with the Patent Search Center, the Taiwan Patent Attorneys Association, and the Asian Patent Attorneys Association to provide on-site patent information services to attendees.All those interested in Taiwan’s EV technology development and patent strategy are warmly invited to attend and explore future innovation opportunities! 15

15Taiwan Patent GO Showcases Winning Entries of the 2024 National Invention & Creation Awards Starting in March

The 2024 National Invention & Creation Award winners were officially announced on January 20, 2025, on TIPO’s website. This year, from 418 qualified entries, a total of 40 outstanding patented works were selected, including 6 Gold Medals and 26 Silver Medals in the Invention Category, and 4 Gold Medals and 4 Silver Medals in the Creation Category.Among the patent holders of the winning works, 50% are corporations (the highest proportion), 22.5% are foundations, 10% are individuals, 10% are government agencies, and 7.5% are academic institutions.In addition to the awards ceremony scheduled for May–June, TIPO has been actively helping award-winning works gain commercial exposure. Since 2024, TIPO has been curating top-tier patents and exhibiting them at various professional trade shows across Taiwan through the Taiwan Patent GO Pavilion. Leveraging the advantages of networking at trade fairs and international business matchmaking, the Taiwan Patent Go helps companies explore commercialization opportunities.The first Taiwan Patent GO Pavilion of 2025 debuted at TIMTOS (Taipei International Machine Tool Show), co-organized by TAITRA (Taiwan External Trade Development Council) and TAMI (Taiwan Association of Machinery Industry). The event took place from March 3 to 8, 2025, at Taipei World Trade Center Hall 1 (TWTC Hall 1). With over 1,000 exhibitors across 6,100 booths spanning three TWTC exhibition halls, TIMTOS is one of the world’s most prestigious exhibitions for smart manufacturing and machine tools.This Taiwan Patent GO Pavilion will feature five award-winning patented inventions, including Gold Medalists from the 2020 National Invention & Creation Award and Platinum Award winners from the 2022 and 2024 Taiwan Innotech Expo (TIE). TIPO extends its best wishes to the exhibiting patent holders and looks forward to successful networking and business opportunities for all participants. 16

162022–2024 Taiwan Innotech Expo (TIE) Platinum Award Compilation Now Available

The 2024 Taiwan Innotech Expo (TIE) successfully concluded on October 19, 2024. This year’s Invention Competition featured 565 participating entries, with only 12 winning the prestigious Platinum Award, resulting in a highly competitive 2% award rate, underscoring the exceptional technological value of the winning innovations.To enhance technology exchange and business matchmaking opportunities for award-winning patent holders, TIPO published the 2022–2024 Taiwan Innotech Expo Platinum Award Compilation, now available on TIPO’s official website. All interested parties are encouraged to explore and engage in potential collaboration opportunities. 17

172025 EU–Taiwan Seminar on Generative AI: Navigating IP Under Generative AI

The 2025 EU–Taiwan Seminar on Generative AI was held on March 25, 2025, at the Tsai Lecture Hall, NTU College of Law. The event was co-hosted by TIPO and the European Economic and Trade Office (EETO). Director General Cheng-Wei Liao of TIPO and Head of Office Lutz Güllner of the EETO delivered the opening remarks.Focusing on the intersection of artificial intelligence and copyright, the seminar featured expert speakers from both Taiwan and the EU, including public sector representatives and industry professionals.The first session was led by Anneli Andresson, Policy Officer at DG TRADE of the European Commission, who presented the text and data mining (TDM) exceptions under the EU’s Digital Single Market Directive and copyright-related provisions in the proposed Artificial Intelligence Act.In the second session, Chia-Hung Kao, Section Chief of TIPO's Copyright Division, offered insights on the legal and practical implications of generative AI and copyright. He highlighted that while no jurisdictions have yet enacted copyright laws specifically targeting generative AI, some AI developers have begun seeking lawful licenses for training data. He emphasized the complexity of balancing copyright protection with innovation, stating that TIPO will continue monitoring international trends and responses closely.The third session featured Amit Datta, Associate General Counsel at Aleph Alpha (Germany), who explored the legal and practical impact of the EU AI Act from an industry perspective.The final session was presented by Chin-Yuan Fan, Division Head at the National Applied Research Laboratories, who introduced the TAIDE Project. Launched in April 2023, the project aims to build a trustworthy Taiwanese AI dialogue engine, and Fan shared challenges encountered during the collection and processing of training data.The seminar drew a total of 185 participants from industry, academia, and the legal community, generating vibrant discussions and meaningful cross-sector exchange. Through diverse perspectives presented by the four speakers, attendees gained a deeper understanding of the complex relationship between generative AI and copyright, and the importance of addressing emerging legal and practical challenges to ensure both the protection of creative works and the advancement of AI technologies. 18

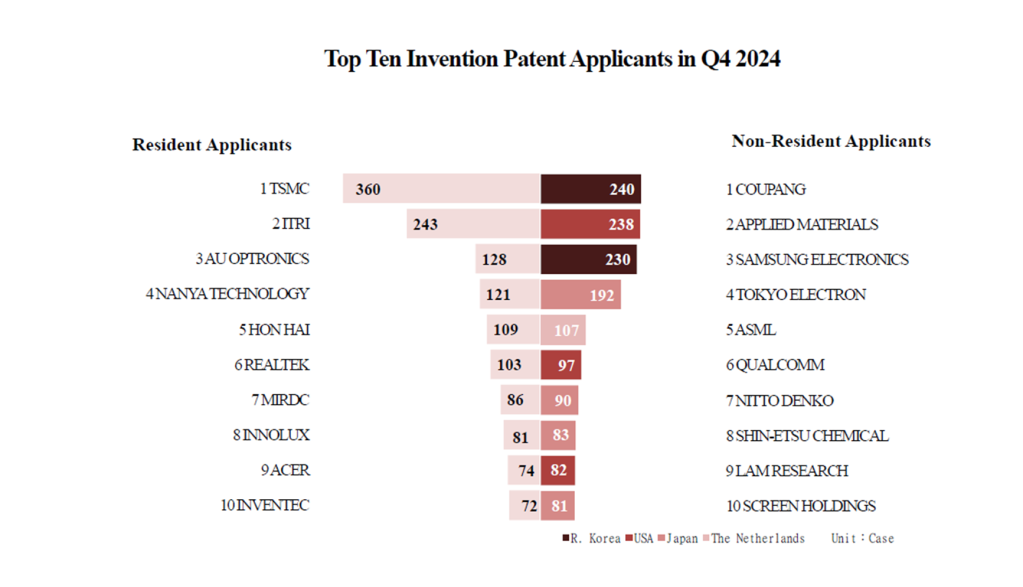

18TIPO’s Q4 2024 IPR Statistics Report

I. Overall Trends in Patent and Trademark ApplicationsIn the fourth quarter of 2024, TIPO received a total of 19,977 patent applications, including 14,107 invention patents, 3,888 utility model patents, and 1,982 design patents, marking a 1% increase compared to the same period in 2023 (Figure 1). Among these, the number of invention patents in the fourth quarter has shown a steady increase over the past five years. The proportion of the total number of all three types of patents from both resident and non-resident applicants was roughly equal. Resident applications rose by 4% compared to the previous year, while non-resident applications saw a slight decrease of 1%.A total of 21,401 trademark registration applications (covering 26,961 classes) were filed, showing an 8% decrease compared to the same period last year (Figure 2). Among these applications, 76% were from residents and 24% from non-residents. The number of trademark applications has shown a declining trend in recent years.II. Overview of Patent Applications Filed by ResidentsTop Ten Invention Patent Applicants Resident invention patent applications totaled 5,546, with 4,259 applications filed by enterprises. The top ten applicants for invention patents were led by TSMC, with 360 applications. The others in the top ten included ITRI (243), AU Optronics (128), Nanya Technology (121), Hon Hai (109), Realtek (103), MIRDC (86), Innolux (81), Acer (74), and Inventec (72) (Figure 4). Notably, TSMC has ranked first for two consecutive years since the fourth quarter of 2023, while Hon Hai saw a remarkable 160% increase in applications compared to the previous year.Top Five Design Patent Applicants Resident design patent applications totaled 938, with the top five applicants led by L&F Plastics, which filed 43 applications. The other top applicants included B'In Music (24), Godmiracle (19), Matsushita Electric (14), and Coplus (13) (Figure 5). Notably, B'In Music and Godmiracle entered the top five for the first time, highlighting their focus on design innovation.Overview of Patent Applications Filed by Non-ResidentsFiling Countries (Regions) of Invention Patent Applicants Non-resident invention patent applications totaled 8,561, with the top five countries/regions led by Japan, which filed 3,194 applications. The other top countries/regions included the US (1,837), R. Korea (1,100), mainland China (1,009), and Germany (303) (Figure 3). Among these, Japan and R. Korea have experienced positive growth for two consecutive years. Particularly, R. Korea has seen growth rates of 16% and 14% over the past two years, demonstrating a highly active patent strategy in Taiwan.Top Ten Invention Patent ApplicantsAmong the top ten non-resident applicants for invention patents, Coupang from R. Korea ranked first with 240 applications, followed by the Applied Materials (238) from the US, Samsung Electronics (230) from R. Korea, Tokyo Electron (192) from Japan, ASML (107) from the Netherlands, Qualcomm (97) from the US, Nitto Denko (90) from Japan, Shin-Etsu Chemical (83) from Japan, Lam Research (82) from the US, and Screen Holdings (81) from Japan (Figure 4). Coupang, Tokyo Electron, and Shin-Etsu Chemical reached record application numbers, with Coupang becoming the top non-resident applicant for the first time. This highlights Taiwan’s importance as a hub for semiconductor R&D and innovation, as well as its appeal for cross-border e-commerce.Filing Countries (Regions) of Design Patent ApplicantsNon-resident design patent applications totaled 1,044, with the top five countries/regions led by mainland China, which filed 221 applications. The other top countries/regions included Japan (198), the US (175), Switzerland (106), and Italy (68) (Figure 3). Notably, mainland China surpassed Japan and the US this quarter, ranking first.Top Five Design Patent ApplicantsAmong the top non-resident applicants for design patents, Gessi from Italy led with 40 applications, followed by the Apple from the US, Harry Winston from Switzerland, and Zhejiang Geely Holding from mainland China, each with 36 applications, and Ford Global Technologies (31) from the US (Figure 5). Notably, Gessi and Zhejiang Geely Holding reached new highs in the number of applications, demonstrating their strong focus on the Taiwan market and active investment in protecting their unique product designs.Overview of Trademark Registration ApplicationsTop Ten Resident Applicants for TrademarksResident trademark registration applications totaled 16,174, with the top ten applicants led by Momo.com, which filed 140 applications. The other top applicants included Gongtian Temple (104), Uni-President (82), Chin Yee Chemical (45), Lungyen Life (40), the ITRI (39), Xu, Yu-Jie (33), Wowprime (32), TaoYuan Long-De Temple (32), and TCI (29) (Table 1).NICE Classification of Resident ApplicationsThe top three categories of resident trademark applications are as follows: Class 35 (advertising, business management, retail and wholesale services, etc.) with 3,174 applications, Class 43 (restaurants, lodgings, etc.) (1,545), and Class 30 (coffee, tea, pastries, etc.) (1,307) (Figure 7). This indicates that resident applicants primarily focus on business management, consumer-related services such as restaurants and accommodations, and products like coffee and pastries.Filing Countries (Regions) of Non-Resident ApplicationsNon-resident trademark registration applications totaled 5,227, with the top five countries/regions led by mainland China, which filed 1,363 applications. The other top countries/regions included Japan (919), the US (729), R. Korea (492), and Hong Kong (267) (Figure 6). Except for the US, the other four countries/regions showed positive growth in their application numbers.Top Ten Non-Resident Applicants for TrademarksAmong Non-resident trademark applicants, the top applicant was Huang Cheng-Fang from mainland China, with 72 applications. The other top applicants were Toyota Jidosha (38) from Japan, Tencent Holdings (35) from the Cayman Islands, Kao (23) from Japan, Procter & Gamble (22) from the US, Celgene (21) from the US, and Bayer from Germany, Target Brands from the US, Kobayashi Pharmaceutical from Japan, and CompanionAI Networks from Singapore, each with 18 applications (Table 2).NICE Classification of Non-Resident ApplicationsThe top three categories of non-resident trademark applications are as follows: Class 9 (computer and technology products, etc.) with 952 applications, Class 35 (advertising, business management, retail and wholesale services, etc.) (652), and Class 3 (cosmetics, detergents, etc.) (583) (Figure 8). Non-resident applicants primarily focused on registering trademarks for computer and technology products (Class 9) in Taiwan, while applications in cosmetics and detergents (Class 3) have been growing rapidly.Analysis of Applications by IndustryThe top industries for trademark applications were "Agriculture" with 5,427 applications, followed by "Health" (4,483) and "Business Services" (4,311).The top three industries for trademark applications are as follows: For resident applicants, "Agriculture" led with 4,329 applications, primarily from trademark applications related to restaurants and accommodations. For non-resident applicants, "Research and Technology" topped the list with 1,488 applications (Figure 9). Additionally, there is a growing number of non-resident trademark applications in both "Health" and "Agriculture."Note: The above statistical analysis for type of applicant and applicant nationality is based on the first applicant.Reference URL: https://www.tipo.gov.tw/en/lp-302-2.html 19

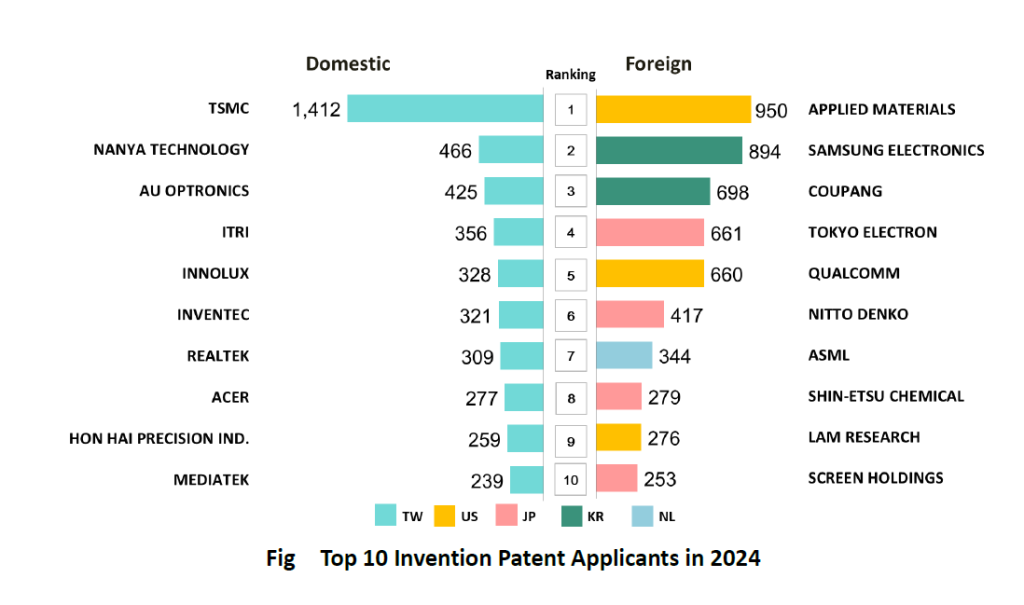

19Top 100 Patent Applicants in 2024

In TIPO’s 2024 Statistical Rankings for Patent Applications and Grants, TSMC maintained its position as the top domestic invention patent applicant for the ninth consecutive year, filing 1,412 applications. As for foreign applicants, US-based Applied Materials returned to the top spot with a total of 950 applications. With 356 invention applications, the Industrial Technology Research Institute (ITRI) outstripped all other research institutions. Among university applicants, National Cheng Kung University filed the most invention patent applications (121). With respect to overall patent grants, TSMC led domestic applications with 1,163 grants, and Applied Materials was the most prolific foreign applicant with 697 grants.TSMC Ranks as Top Domestic Invention Patent Applicant for the Ninth Year StraightFor the ninth consecutive year, TSMC led domestic applications with 1,412 invention patent applications in 2024. Nanya Tech (466) followed in second place, trailed by AU Optronics (425), ITRI (356), Innolux (328), Inventec (321), Realtek (309), Acer (277), Hon Hai Precision Industry (259), and Mediatek (239). Among the top ten domestic applicants, Nanya Tech and Innolux hit new records, while Hon Hai Precision Industry exhibited the fastest growth rate at 93% (Fig, Table 1).Among the top 20 domestic applicants, United Microelectronics (ranking 12th with 221 applications), Winbond Electronics (ranking 13th with 160) and Powerchip Semiconductor Manufacturing Corp (ranking 17th with 131) also gained their all-time highs (Table 1).Applied Materials returned to the top spot among foreign invention patent applicantsOn the foreign applicant front, US-based Applied Materials reclaimed the top spot with 950 applications in 2024, followed by Samsung Electronics of the Republic of Korea (894), Korea-based Coupang (698), Japan-based Tokyo Electron (661), US-based Qualcomm (660), Japan-based Nitto Denko (417), ASML Netherlands (344), Shin-Etsu Chemical (279), US-based Lam Research (276), and Screen Holdings (253). Among the top 10 foreign applicants, the sharpest increase in 2024 was for Coupang (+54%). Furthermore, Coupang, Tokyo Electron, ASML Netherlands, Shin-Etsu Chemical, and Lam Research all posted record high overall applications (Fig, Table 2).Among the top 20 foreign applicants list in 2024, Japan led with 11 applicants. Additionally, Resonac (ranking 11th with 251 applications), Huawei Technologies (ranking 17th with 184 applications) and Wonderland Switzerland (ranking 18th with 167 applications) also hit all-time highs (Table 2).ITRI Remains Top Invention Patent Applicant for 18 Years Running, While National Cheng Kung University Leads Among University Applicants for Third Year StraightFive research institutes also ranked among the top 100 domestic invention patent applicants in 2024. The Industrial Technology Research Institute (ITRI) placed 4th with 356 applications, maintaining its top position among research institutes for the 18th consecutive year (Table 3).Twenty-one schools were among the top 100 domestic invention patent applicants in 2024. National Cheng Kung University (121) claimed the first spot, followed by National Taiwan University (98), National Tsing Hua University (83), National Chin-Yi University of Technology (75), National Yang Ming Chiao Tung University (74), National Pingtung University of Science (60), National Taipei University of Technology (55), National Sun Yat-Sen University (51), National Taiwan University of Science And Technology (49), and National Chung Hsing University (48). Notably, Taipei Medical University (ranking 11th with 47 applications) emerged at the top among private universities (Table 4).The trend in design patent applications in 2024, Chang Gung University of Science and Technology led with 51 cases, followed by Shu Te University (34). In respect of overall patent applicants, Taipei City University of Science and Technology ranked first among schools with 177 applications (most of which are utility model applications) for the 5th straight year (Table 5). 20

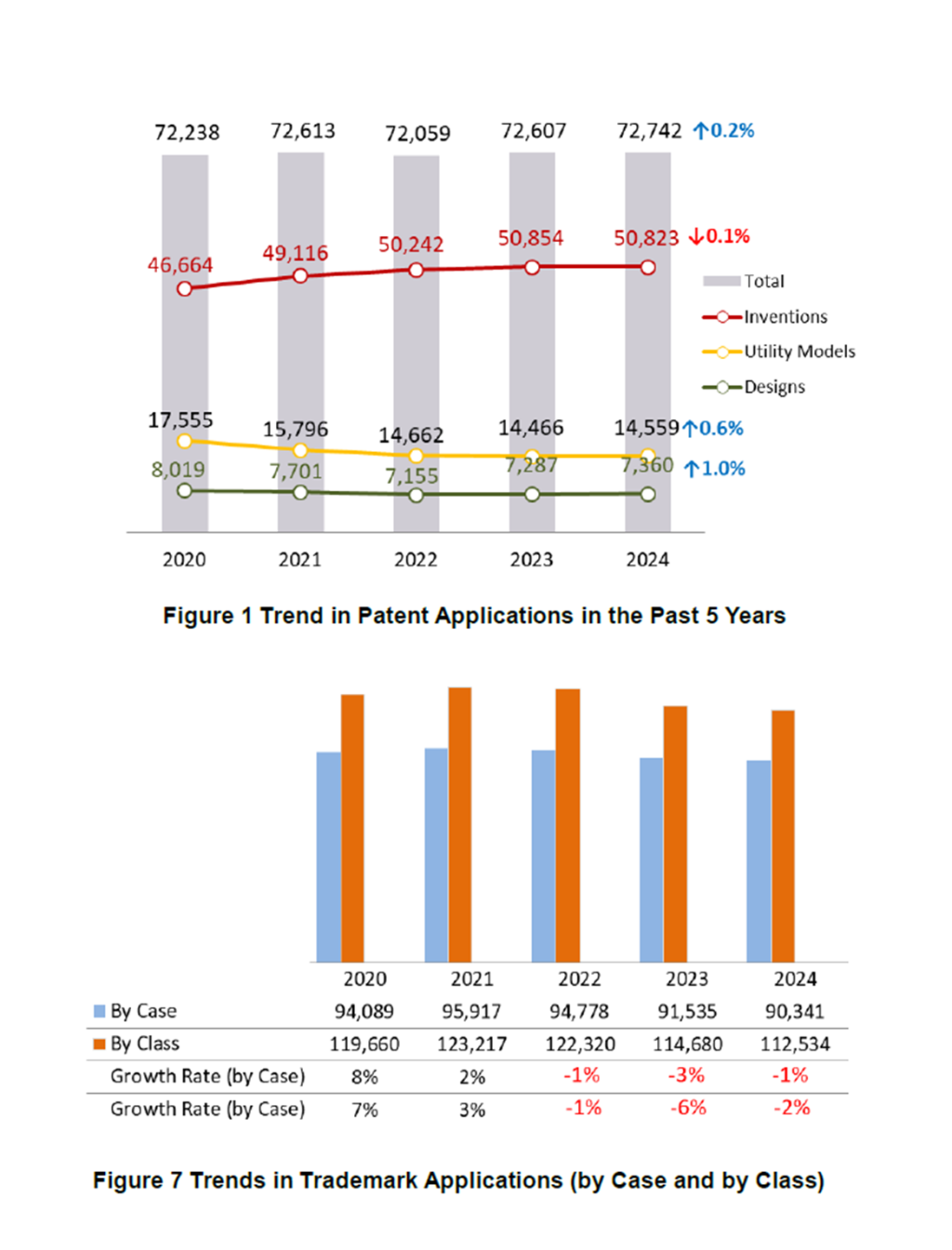

20TIPO Statistics Report: Patent and Trademark Applications in 2024

In 2024, TIPO received a total of 72,742 patent applications, roughly the same as 2023. Of these, invention patents (50,823) experienced a slight decrease, utility model patents (14,559) experienced a positive turnaround, while design patents (7,360) continued growing. Trademark applications (90,341) experienced a slowed decrease. As to examination efficiency, the average first action pendency was 8.4 months for invention patent applications and 6.1 months for trademark applications.Invention and Utility Model Applications from Domestic Industries Show Diverse Patent Portfolios, While Those From Domestic Universities and Research Institutes SurgeDomestically, in 2024, invention patent applications (19,586) decreased by 0.2%, while utility model applications (13,341) increased slightly by 0.2%. By applicant type, invention patent applications decreased by 1% but utility model applications increased by 3% for domestic industries, showing diverse patent portfolio strategies. Invention patent applications from domestic universities and research institutes surged by 3-8%, and utility model applications by 13-57%. Design applications (3,338) were down by 3%, mainly due to decreases in filings from universities, while those from enterprises rose by 5% (Table 1, Figure 2, Figure 3).Japan Leads in Foreign Invention and Design Patent ApplicationsForeign invention patent applications (31,237) rose by a slight 0.1% in 2024. A breakdown by applicant nationality shows Japan maintaining its lead with 12,307 applications, followed by the US (6,817), Mainland China (3,472), the Republic of Korea (3,365), and Germany (1,035), among which R. Korea reached a record high. Furthermore, R. Korea and Germany had the fastest growth rate of 8% among the top 5 countries (regions), while the US also rose by 1%. However, Japan and Mainland China fell by 2% and 9%, respectively. (Table 1, Figure 4).Non-resident applications for design patents increased by 4% to 4,022 applications in 2024. Japan also topped the list of countries filing design patents in Taiwan with 880 applications, followed by the US (772) and Mainland China (755), Switzerland (370), and Germany (241). Among the top 5 countries (regions), Mainland China saw a sharp increase of 61%, while Germany rose by 1%. However, Japan, the US, and Switzerland all fell by 6% (Table 1, Figure 5).Trademark Applications See Smaller Decrease of 1%The number of trademark applications stood at 90,341 (covering 112,534 classes – a 2% decrease from the previous year) in 2024, marking a decrease by 1%, smaller than the drop (-3%) in 2023. Notably, there was a 4% decrease in resident applications (69,386), while non-resident applications experienced a turnaround by rising 7% (20,955) (Table 1, Figure 7, Figure 8).Among the top 5 trademark-filing countries (regions), mainland China (5,624) took the lead, followed by Japan (3,397), the US (2,822), R. Korea (1,919) and Hong Kong (1,227). Among the top 5 countries (regions), the US was down by 3%, while others saw an impressive growth of 13-28% (Figure 9).UNI-PRESIDENT Ranks as Top Resident Trademark Applicant for Sixth Year Straight, While TENCENT HOLDINGS Leads Among Non-ResidentsFor the sixth year in a row, Uni-President remained as the top resident trademark applicant with 709 applications in 2024. MOMO.COM (216) follows in second, while Wu, Ruo-Mei (163) and the other top 5 applicants filed trademarks in or related to religious temples. With regard to non-resident applicants, Tencent Holdings of Cayman Islands continued to take the lead with 146 applications, followed by L'Oreal of France (86) and Kao of Japan (81) (Figure 10).Resident trademark applications were mostly filed in Class 35 (Advertising; business management) (13,407). Among the top 10 classes, Class 3 (Cosmetics and toiletry preparations), Class 5 (Pharmaceuticals) and Class 42 (Scientific and technological services) had growth rates of between -0.3% (negative growth) and 2.2%, while other classes decreased at rates between 1.8% to 10.6% (Table 2).Most non-resident trademark applications were filed in Class 9 (computer and technology) (3,848). Among the top 10 classes, Class 3 (Cosmetics and toiletry preparations), Class 25 (Clothing, footwear, headwear) and Class 18 (Leather and imitations of leathers, luggage) all saw double-digit growth between 12.2-15.4%, while Class 5 (Pharmaceuticals) and Class 42 (Scientific and technological services) fell by 3.7% and 9.8% respectively (Table 2).Optimized Patent and Trademark Examination Pendency Facilitates Industry PortfoliosTIPO is dedicated to optimizing patent and trademark examination quality and efficiency to support industries by expediting the grant process and building their portfolio. As a result, the average first action pendency was 8.4 months for invention patent applications in 2024, down by 0.5 months compared to 2023. The number for pending applications was 52,712 (Figure 6). For trademark applications, the average first action pendency was 6.1 months, shortened by 0.1 month. The number for pending applications fell to 52,860 (Figure 11). 21

21TIPO Publishes 2025.01 Edition of International Patent Classification Information

The information for the 2025.01 edition of the International Patent Classification (IPC) has been published on TIPO’s official website. Starting February 5, 2025, TIPO will adopt the new edition (2025.01) for classifying newly filed patent applications. Consequently, the Patent Gazette will reflect the updated classification starting from the March 11, 2025 issue, and the Invention Publication Gazette will adopt the new classification from the April 16, 2025 issue. 22

222024 Interview Series on Outstanding Female Leaders in the Field of IP in Taiwan

To highlight the achievements and career development of female professionals in Taiwan's IP sector, TIPO has launched the "2024 Interview Series on Outstanding Female Leaders in the Field of IP in Taiwan." This series features interviews with four distinguished women in the IP field: Billie Chen, Associate General Counsel at TSMC, Chih-Chieh Lin, Professor at National Yang Ming Chiao Tung University, Pei-Chun Chen, Chief Technology Officer at Microsoft AI R&D Center, and Hsiu-Ru Chien, Partner at Lee and Li Attorneys-at-Law.TIPO hopes that the 2024 Interview Series on Outstanding Female Leaders in the Field of IP in Taiwan will continue to serve as a source of inspiration, encouraging more women to pursue careers in the field of IP and break down gender barriers. 23

23Industry Collaborative Patent Interview Pilot Program Extended to December 31, 2026

The Industry Collaborative Patent Interview Pilot Program, launched in 2023, was initially set to expire on January 2, 2025. To address applicants' need for expedited patent approval and to support the development of their patent portfolios, TIPO has extended the pilot program through December 31, 2026. 24

24TIPO Releases Report on "Patent Trend Analysis for Key Components in the Electric Vehicle Industry"

To achieve the goal of transitioning to fully electrified transportation by 2050, Taiwan has been actively promoting policies for developing key components of the electric vehicle industry. As electric vehicles continue to evolve toward greater intelligence and higher performance, thermal management and cooling technologies have emerged as critical challenges.On December 2, 2024, TIPO published the "Patent Trend Analysis for Key Components in the Electric Vehicle Industry" report. The report focuses on the automotive industry's response to net-zero carbon emissions and electrification, analyzing patents related to electric vehicle cooling technologies from 2014 to 2023. It categorizes these patents into three main areas: battery cooling, motor cooling, and thermal management systems. Additionally, the report highlights patent trends and shares specific examples within these categories. The report is now available for reference. 25

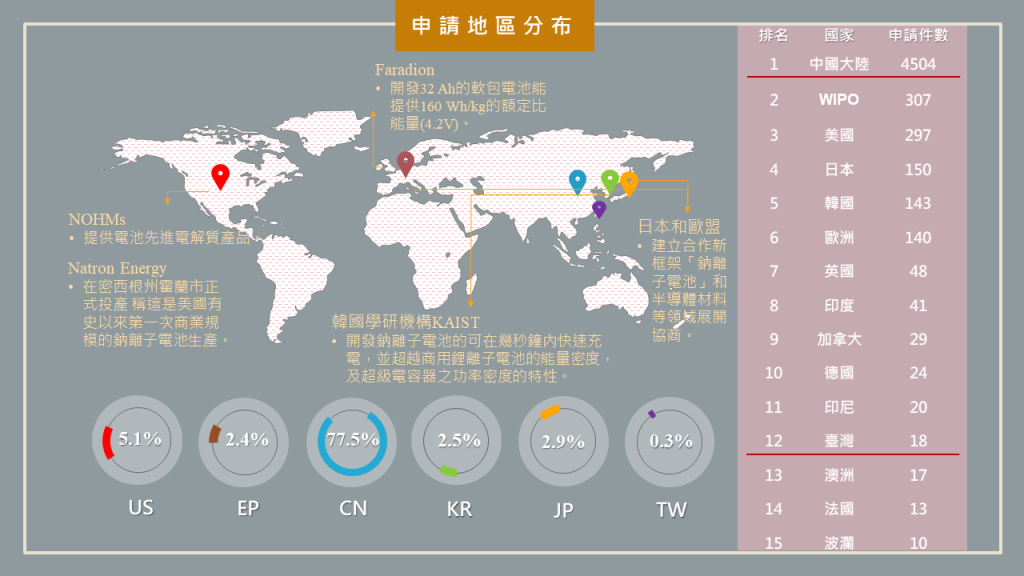

25Patent Search Center Releases Two Reports: "Patent Landscape Analysis of 5G and AIoT Integrated Applications" & "Patent Technology Analysis of Sodium-Ion Batteries"

Amid the global trends of achieving net-zero emissions and advancing digital transformation, the development of 5G and AIoT technologies, as well as sodium-ion battery innovations, have become critical focal points. Commissioned by TIPO, the Patent Search Center has completed two patent analysis reports: "Patent Landscape Analysis of 5G and AIoT Integrated Applications" and "Patent Technology Analysis of Sodium-Ion Batteries" - the former examines patent developments related to sensor nodes and network architecture technologies, while the latter provides a comprehensive analysis of patent trends and industrial applications for battery cell materials.These reports aim to provide valuable references for governments and businesses to formulate technology development strategies, plan for future market opportunities, and enhance Taiwan’s competitiveness within the global value chain. 26

26TIPO Launches "Industry Patent Knowledge Platform" Service on the "IP Info Cloud"

In alignment with the government’s cloud policy and to enhance service quality for the public, TIPO has been developing the IP Info Cloud since 2021. Utilizing public cloud infrastructure, this initiative aims to establish a cloud-based service platform with high availability and scalability. As part of this effort, the Industry Patent Knowledge Platform website was successfully migrated to the cloud in 2024 and is now available for trial use.The platform's user interface has been optimized to unify the desktop and mobile versions, supporting seamless browsing across devices such as computers, tablets, and smartphones. Users can easily access resources such as patent documents, expert articles, the latest IP news, information on patent systems from various countries, and insights from academic experts. TIPO welcomes continued support and feedback from users. 27

27TIPO Announces Revised “Positive Patent Examination Pilot Program for Startup Companies”

To enable eligible startup companies that have received national awards or participated in TIPO-sponsored programs to obtain patents within four months of application, thereby strengthening their competitive edge in the industry, TIPO has revised the "Positive Patent Examination Pilot Program for Startup Companies." The eligibility criteria have been expanded from startups established for less than eight years to also include companies with innovative R&D capabilities that have received national awards within the past two years and companies guided by organizations commissioned by TIPO. The revised program took effect on January 1, 2025. 28

28TIPO Launches the Design Patent Online Application System – Now Open to the Public for New Design Patent and Derivative Design Applications!

To streamline online patent applications, TIPO has introduced a brand-new, web-based Design Patent Online Application System. Starting in 2024, the system offers a wide range of features, including new applications, re-examinations, amendments, submissions, issuances, annuity fee payments, making responses, withdrawals, postponements, and assignments related to design patents and derivative design patents.Users no longer need to install standalone tools, as the system is accessible directly through a browser and supports cross-device functionality. 29

29Trial Period for the "Accelerated Examination Pilot Program for Design Patents" Extended by Two Years

To provide more diverse and flexible examination options for design patent applications, TIPO launched the "Accelerated Examination Pilot Program for Design Patents" on September 1, 2023. Initially set to run until December 31, 2024, the program has now been extended through December 31, 2026. A further evaluation will determine whether to continue or modify the program. The details of the program are as follows:1. Application Timing: Applicants may file for accelerated examination for design patents after receiving TIPO’s notification that the preliminary examination is about to begin and before receiving the first Office Action.2. Application Process: Applicants must file electronically in accordance with TIPO’s regulations and provide relevant supporting documents. During the trial period, no application fee will be charged for this program.3. Eligibility Criteria:(1) Criterion 1: Third-Party Commercial ExploitationApplicants must submit documentation proving third-party commercial exploitation (e.g., product catalogs, newspaper, or magazine articles) and specify the third party’s details, the nature of the exploitation, and its starting date.(2) Criterion 2: Recognition by Prestigious Design AwardsApplicants must provide certificates and evidence of the awarded design corresponding to the applicant's name. Eligible awards include:Taiwan's Golden Pin Design AwardGermany's iF Design AwardGermany's Red Dot Design AwardJapan's Good Design AwardThe United States' International Design Excellence Awards (IDEA)(3) Criterion 3: Design Patent Applications by StartupsEach startup is limited to three applications per year under this program. Eligible startups must be companies established for less than eight years under the Company Act or equivalent foreign laws. The establishment period is calculated from the company’s registration date to the design patent application date. If priority is claimed, the calculation is based on the earliest priority date.For foreign companies, proof of the establishment date must be provided along with a Chinese translation. If the document is not an original, a declaration must be submitted. 30

30The 4th Canada-Taiwan IP Policy Dialogue was successfully held in Taipei

The 4th Canada-Taiwan Intellectual Property Policy Dialogue was held in Taipei on 3 December 2024.Both sides exchanged opinions on and discussed the following topics: Experience and Outcomes in Digital Transformation; Patent Grace Period; and Promoting IP Awareness. 31

31TIPO’s Q3 2024 IPR Statistics Report

I. Overall Trends in Patent and Trademark ApplicationsIn the third quarter of 2024, TIPO received a total of 18,267 patent applications across three categories: 12,739 for invention patents, 3,679 for utility model patents, and 1,849 for design patents, representing a slight 0.2% decrease compared to the same period in 2023. Notably, invention patent applications have exhibited a gradual upward trend over the past five years during the third quarter. Resident applicants accounted for 49% of the total patent applications, while non-resident applicants contributed 51%. Compared to the previous year, applications from resident applicants decreased by 2%, whereas those from non-resident applicants increased by 2% (Figure 1).In the third quarter of 2024, a total of 23,304 trademark applications (covering 29,258 classes) were filed, representing a 1% decrease compared to the same period last year. Among these, resident applicants accounted for 77% and non-resident applicants for 23%. Over the past two years, trademark applications during the third quarter have shown a downward trend, with this year’s decline narrowing to 1% (Figure 2).II. Overview of Patent Applications Filed by ResidentsTop Ten Invention Patent ApplicantsResidents filed 4,857 invention patent applications, with enterprises accounting for 3,881 of these applications. Among the top ten applicants, TSMC ranked first with 331 applications, followed by AU Optronics (99), Inventec (94), Nanya Technology (88), Innolux (84), Delta (81), Hon Hai (76), UMC (75), Realtek (73), and MediaTek (66)(Figure 4). It is worth noting that TSMC has maintained the top position for nine consecutive years since the third quarter of 2016. Delta achieved a record high number of applications, while Hon Hai showed rapid growth, indicating their strategic intent in patent portfolio development.Top Five Design Patent ApplicantsResident applicants filed 790 design patent applications. Among the top five applicants, Tarng Yu led with 16 applications, followed by CGUST and Hsien Chang Optical (both 13). Acer and L&F Plastics ranked next (both 12)(Figure 5). Among them, Hsien Chang Optical set a new record for the number of applications filed, as well as for its own ranking.Overview of Patent Applications Filed by Non-ResidentsFiling Countries (Regions) of Invention Patent ApplicantsNon-residents filed 7,882 invention patent applications. The top five countries (or regions) were Japan with 3,058 applications, followed by the US (1,724), mainland China (898), R. Korea (872), and Germany (252)(Figure 3). In particular, applications from R. Korea have gradually increased, indicating its growing emphasis on strengthening patent portfolios in Taiwan.Top Ten Invention Patent ApplicantsAmong the top ten non-resident applicants for invention patents, Applied Materials from the US filed 254 applications, regaining the top position. It was followed by Samsung Electronics (222) from R. Korea, Qualcomm (202) from the US, Coupang from R. Korea and Tokyo Electron from Japan (both 175), Nitto Denko (101) from Japan, Fujifilm (91) from Japan, ASML (90) from the Netherlands, Kioxia (83) from Japan, and Resonac (71) from Japan (Figure 4). Notably, both Applied Materials and Tokyo Electron achieved record-high filing numbers.Filing Countries (Regions) of Design Patent ApplicantsNon-resident applicants filed 1,059 design patent applications. The top five countries (or regions) were Japan, leading with 221 applications, followed closely by the US (220), mainland China (210), Germany (83), and Switzerland (76) (Figure 3). Significantly, the US was nearly on par with Japan in filing numbers, while mainland China trailed closely behind.Top Five Design Patent ApplicantsAmong the top five non-resident applicants for design patents, Apple (US) led with 50 applications. It was followed by Beijing Roborock from mainland China and BMW from Germany (both 40), China Wonderland (27) from mainland China, and Ford Global Technologies (25) from the US (Figure 5). Notably, Apple retained its leading position, reflecting its strategy of protecting new products through design patents, while Beijing Roborock achieved a record-high number of filings.Overview of Trademark Registration ApplicationsTop Ten Resident Applicants for TrademarksResident applicants filed 17,962 trademark registration applications. Among the top ten applicants, Uni-President ranked first with 236 applications, followed by Bao-Hu Temple Tian-Di Hall (106), Wu, Ruo-Mei (103), Chunghwa Telecom (84), Go Far (78), R&R Medical (67), Cathay Financial Holdings (60), Cathay Life Insurance (55), Microjet Technology (50), and Gamania Digital (44)(Table 1).NICE Classification of Resident ApplicationsThe top three trademark application categories filed by resident applicants were as follows: Class 35 (advertising, business management, retail and wholesale services, etc.) with 3,496 applications, Class 43 (restaurants, lodgings, etc.) (1,629), and Class 30 (coffee, tea, pastries, etc.) (1,481) (Figure 7). This indicates that trademark filings in Taiwan are primarily concentrated in areas related to business operations, consumer services such as hotel and dining, and consumer foods like coffee and pastries.Filing Countries (Regions) of Non-Resident ApplicationsNon-resident applicants filed 5,342 trademark registration applications. The top five countries (or regions) were mainland China, with 1,472 applications, followed by Japan (837), the US (693), R. Korea (540), and Hong Kong (317) (Figure 6). Except for the US, the number of applications from the other four countries (or regions) increased by 15% to 47%.Top Ten Non-Resident Applicants for Trademarks The top ten non-resident applicants for trademark registration were led by Hong Kong's CUYI with 50 applications, followed by Beijing Roborock (44) from mainland China, Boehringer Ingelheim (39) from Germany, Tencent (37) from Cayman Islands, Shizutetsu (34) from Japan, Frasers Property from Singapore and Beijing Jingdong from mainland China (both 32), L'Oreal (28) from France, and LG H&H and HanGo from R. Korea (both 24) (Table 2). NICE Classification of Non-Resident ApplicationsThe top three trademark application categories filed by non-resident applicants were as follows: Class 9 (computers and technology products, etc.) with 985 applications, Class 35 (advertising, business management, retail and wholesale services, etc.) (589), and Class 3 (cosmetics and detergents, etc.) (579) (Figure 8). Non-resident applicants primarily focused on trademark registration for computer and technology products under Class 9.Analysis of Applications by IndustryMost trademark applications were classified under “Agriculture” with 5,844 applications, followed by "Health" (4,810), and "Business Services" (4,628) (Figure 9).Among the top three industries for trademark applications, resident applicants are concentrated in "Agriculture" with 4,714 cases, primarily for trademarks related to restaurants and accommodations. Non-resident applicants have the highest number in "Research and Technology" with 1,514 cases (Figure 9). Additionally, resident applicants saw a 2% increase in filings under the "Health" category, while non-resident applicants experienced a 22% increase in filings under the "Agriculture" category, with both showing growth.Note: The above statistical data is based on the “first applicant” of the applications when referencing applicants and nationalities.Reference URL: https://www.tipo.gov.tw/en/lp-302-2.html 32

32TIPO Launches New Trademark Search System

To improve usability and support mobile browsing, TIPO has launched a new Trademark Search System with simplified and advanced search features to meet the needs of different users. The new system also increases the number of displayed search results to 1,000 entries, reducing the need to repeatedly narrow search criteria.The old system will no longer be available from March 2025. Users are encouraged to switch to the new system. 33

33TIPONet Expands Online Services for Changing Applicants’ Representatives

To facilitate changes for patent and trademark applicants and reduce the need for administrative correspondence between applicants and TIPO, TIPO has expanded the online services available through TIPONet. Starting October 15, 2024, applicants can now use the platform to change their representatives. After logging in to TIPONet, applicants or their patent agent can select the "Applying for a patent/Changing Online" feature to modify basic case information, including:1. The name of the applicant’s representative in Chinese and English.2. The applicant and their patent agent’s address in Chinese and English, phone number, and email address.For assistance with technical issues, please contact the TIPONet Customer Service Line or Email: [email protected]. 34

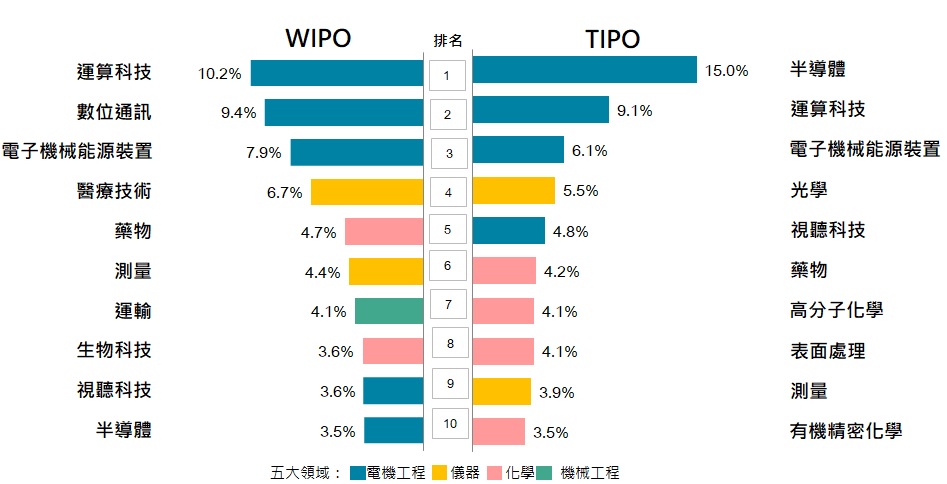

34TIPO Releases 2023 Trends & Comparisons: Taiwan Invention Patent Applications and WIPO PCT Applications

The 2023 Trends & Comparisons: Taiwan Invention Patent Applications and WIPO PCT Applications released by TIPO revealed that WIPO received an estimated 272,600 PCT invention patent applications in 2023, a 1.8% year-on-year decrease, ending a 13-year growth streak. In contrast, TIPO received 50,854 applications, marking a 1.2% increase.In 2023, the top three technical fields for WIPO applications were Computer Technology (10.2%), followed by Digital Communication (9.4%) and Electrical Machinery, Apparatus, and Energy (7.9%). For TIPO, the top field was Semiconductors (15.0%), followed by Computer Technology (9.1%) and Electrical Machinery, Apparatus, and Energy (6.1%).Regarding the primary countries/regions and their focus areas under WIPO patent filings, China had the highest share in Digital Communication (15.6%), while the United States focused most heavily on Computer Technology (12.9%). Japan (11.3%) and Germany (11.8%) predominantly filed in the field of Electrical Machinery, Apparatus, and Energy, whereas South Korea showed an equal focus on Electrical Machinery, Apparatus, and Energy and Digital Communication (both at 11.2%). In comparison, Taiwan, China, the United States, Japan, and South Korea all ranked Semiconductors as the top field under TIPO filings, with shares ranging from 12.5% to 25.7%.Under WIPO patent publications, China’s Huawei ranked first for the seventh consecutive year with 6,494 applications, followed by South Korea’s Samsung Electronics (3,924 applications) and the United States’ Qualcomm (3,410 applications). For TIPO patent publications, TSMC (Taiwan Semiconductor Manufacturing Company) took the top spot for the fifth consecutive year with 1,582 applications, followed by Applied Materials (794 applications) from the US, Samsung Electronics (747 applications) from South Korea, and Qualcomm (695 applications) from the US. Notably, both Samsung Electronics and Qualcomm were included among the top 10 applicants in WIPO and TIPO filings.For WIPO, six of the top 10 applicants, including Huawei, focused most heavily on the Digital Communication field. Huawei, in particular, allocated 41.8% of its filings to Digital Communication, followed by Computer Technology (22.7%) and Telecommunications (9.5%), comprising a combined share of 74.0%. Under TIPO, six of the top applicants, including TSMC, concentrated on Semiconductors, with TSMC allocating the largest proportion at 78.1%.Samsung Electronics displayed contrasting filing priorities between WIPO and TIPO, with Digital Communication as the top field for WIPO and leading with Semiconductors for TIPO. Qualcomm, however, maintained Digital Communication as its highest-priority field across both WIPO and TIPO, demonstrating minimal variation in its filing strategy.In Taiwan, Hsinchu City recorded the highest number of invention patent applications with 4,842 filings, setting a new all-time high. It was followed by Taipei City (3,058 filings) and New Taipei City (2,989 filings). The combined filings from the Taipei-Hsinchu region accounted for 72.4% of all domestic invention patent applications.The 2023 Trends & Comparisons: Taiwan Invention Patent Applications and WIPO PCT Applications is now available on TIPO’s official website for public reference. 35

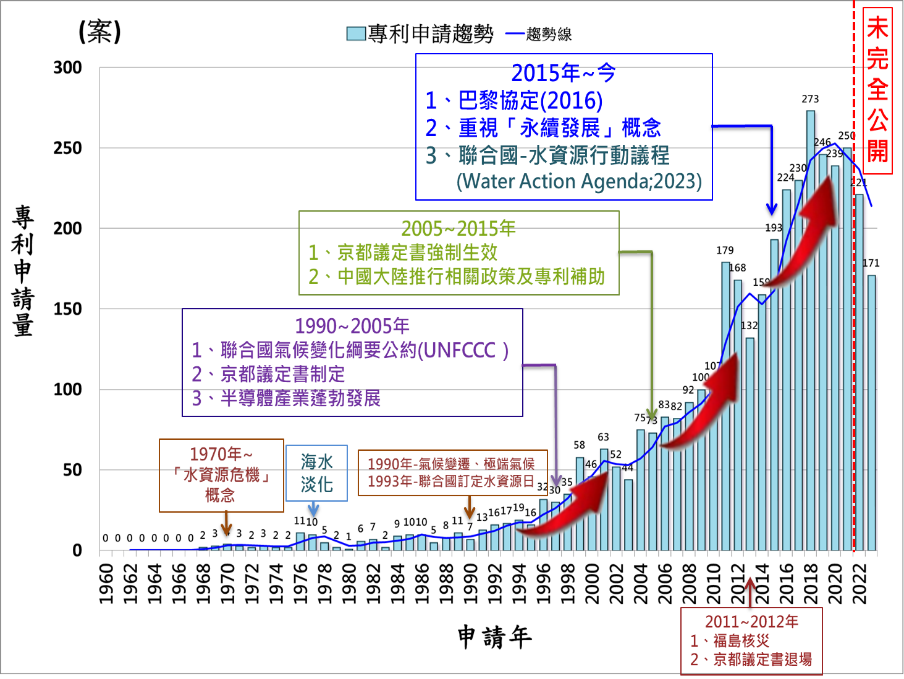

35TIPO Releases the Patent Trends on Wastewater Treatment and Recycling Technologies in Semiconductor Industry Report

In line with Taiwan's vision for the sustainable development of the semiconductor industry, TIPO has released the Patent Trends on Wastewater Treatment and Recycling Technologies in Semiconductor Industry Report. The report shares concrete case studies and offers an in-depth analysis of patent development and technology trends in this field, serving as a key reference for industry efforts in promoting green transformation.The report highlights that over the past 20 years, there has been a significant increase in global patent applications related to wastewater treatment and water recycling technologies, reflecting the strong focus of businesses on sustainability and ESG (Environmental, Social, and Governance) issues. Through advancements in wastewater recovery and water recycling technologies, the global semiconductor industry has made notable progress toward sustainable water resource management. As one of the world’s major producers of semiconductor components, Taiwan has a well-established industry chain and technological foundation, with R&D achievements comparable to those of the US, Japan, and Europe. This contributes significantly to Taiwan's goal of achieving net-zero transformation by 2050. 36

36TIPO Publishes English Version of Patent Examination Guidelines, Part II: Substantive Examination for Invention Patents, Chapter 6 “Amendments”

TIPO has released the English version of the Patent Examination Guidelines, Part II: Substantive Examination for Invention Patents, Chapter 6 “Amendments” to enhance the international IP community’s understanding of Taiwan’s patent examination process.This chapter outlines the appropriate timing for proposing amendments and explains how admissibility is evaluated during the examination process. Moreover, it functions as a helpful tool for foreign applicants, enabling them to assess whether their patent applications meet specified Guideline requirements. 37

37New System for Telephone Communication with External Examiners and Remote Video Interview Launched Officially on September 1

Starting September 1, 2024, TIPO has introduced the Optimization Program for Telephone Communication and Remote Video Interviews with External Examiners on a pilot basis. Invention patent applicants can now use TIPO's three-way conference call system to facilitate real-time communication and exchange of opinions between the applicant or their representative, the external examiner, and TIPO examiners. For more complex cases or those requiring demonstrations, a remote video interview can also be arranged, allowing direct interaction with the external examiner and TIPO examiners. This initiative is designed to enhance the quality of patent applications and improve the efficiency of the examination process. 38

38TIPO Invites German IP Experts to Speak in Taiwan

On September 5, 2024, TIPO invited Klaus Bacher, Presiding Judge of the Federal Court of Justice of Germany, along with patent attorneys and partners Dr. Heinz Goddar and Dr. Ute Kilger at Boehmert & Boehmert, to talk on topics such as the "German Federal Court of Justice Ruling on the DABUS Case," the "EU Supplementary Protection Certificates (SPC) and SPC Manufacturing Waiver," and the "2024 EU Artificial Intelligence (AI) Act."The talks featured lively exchange, contributing to a deeper understanding within TIPO of the differences in inventor determinations between Germany, the EPO, and the US, as well as insight into the EU’s Pharmaceuticals Package amendment proposal and the AI Act, which will take effect on August 1, 2024, in the EU. 39

39TIPO Publishes the 2023 Compilation of Selected Court Decisions on Trade Secret Cases on Official Website for Public Reference

To promote public understanding of the development of trade secret judicial practices in Taiwan, TIPO has published the 2023 Compilation of Selected Court Decisions on Trade Secret Cases.22 cases were selected by sifting through 67 civil and criminal decisions relating to trade secrets in 2023, and then examined and categorized based on key issues: the three elements of trade secrets, trade secrets infringement, and trade secrets related rulings Court decisions were summarized, compiled, and have been published on TIPO's official website as of August 13, 2024 in the Trade Secrets section for public reference. 40

40TIPO Releases Analysis of Taiwan's Green Trademark Industry – Now Available for the Public!

Following the 2023 publication of the Comparative Analysis of Taiwan's Green Trademark Industry in the Last Ten Years, TIPO has continued its research by incorporating the latest statistics to analyze the current state of Taiwan's green trademark industry. The newly completed Analysis of Taiwan's Green Trademark Industry offers insights for businesses on how to strategically position their green trademarks to address global climate change and net-zero emission strategies.Referring to the European Union’s definition of green trademarks, TIPO defines "green trademarks" not by the "trademark reproduction" itself but by the designated goods and services contained in the trademark applications and their Nice Classification. The report examines the distribution of applications over the past decade in nine major categories: energy products, transportation, energy conservation, reuse/recycling, pollution control, waste management, agriculture, environmental awareness, and climate change. It also includes data on the number of applications, percentages, and trends in each category.Over the past decade, green trademarks have accounted for approximately 14.49% of all trademark applications in Taiwan, demonstrating an increase from an average of 13.00% in the early period (2014-2016), 15.31% in the mid-term (2017-2020), to 14.64% in the later period (2021-2023). While there was a slight decline in the latter period compared to the mid-term, the long-term trend demonstrates a growing awareness of carbon reduction, low-carbon initiatives, and green energy within trademark applications. The top three categories are energy conservation, pollution control, and energy products, accounting for nearly 80% of all green trademark applications, highlighting the industry's focus in these three key areas.

Sitemap

Sitemap FAQs

FAQs Feedback

Feedback Bilingual Glossary

Bilingual Glossary